May 21, 2016

Thank you for joining in the March today and possibly participating in the TPP and TTIP discussion. Special thanks to Bren (did I spell it right?) for filling in the holes. Here is a compilation and summary of links that explain the obvious and hidden dangers of allowing corporations to write international law.

Please send an email to brucewgoldsmith@mail.com with the subject. “Let me know when you update the TPP page.”

There is still hope. PLEASE personally let your congressman and staff know that this could be disastrous for all of us from jobs, oil, the environment, our medicines AND OUR FOOD!!!!

TPP

What if you believe where a food comes from is important?

Because of WTO our congress agreed to remove country of origins labels from meat products to level the playing field so you won’t know where your meat comes from.

Because of NAFTA – Canada suing US 15 billion over keystone

$100 per tax payer for profits they might have realized in the future.

TPP and TTIP drastically expand the number of corporations that can attack us outside of the courts. Tribunals are stocked with unaccountable private lawyers to sue us for our health and corporate policies BEHIND CLOSED DOORS.

I have highlighted items in red for a quicker review of concerns

How Will the TPP Affect the Food System?

By Linda Wells on January 21, 2014

If you’re like me, you’ve known for a while that the U.S. is negotiating a new trade deal called the Trans-Pacific Partnership (TPP), but you haven’t taken the time to figure out exactly why it matters. Hey, I don’t blame us—there’s a reason it’s hard to understand: The corporations and governments negotiating the deal don’t want our opinions slowing down their shiny new free-trade agreement.

In fact, if everything goes as planned, very few of us—not reporters, only a handful of legislators, and certainly not you or me—will get to read the deal before it is signed into law. But recently there have been some big hiccups in that plan, making me think it is actually possible to stop this thing if we all start paying attention right now.

In case you missed it, last November the TPP ran into opposition from both the House of Representatives and Wikileaks. I figure it’s time to weigh in on how we think the TPP will impact food and farming. So, let’s dig in…

This is like NAFTA, right?

Let’s start with the basics: The TPP is a free-trade agreement between the United States and 11 other countries in the Pacific region. It’s similar to NAFTA in that it creates specific rules for all the governments involved to decrease regulation of trade, making it easier for multinational corporations to invest in new markets and sell products abroad.

One scary similarity between these two trade agreements is that they both set up a mechanism for corporations to sue governments if profits are disturbed by government regulations. This provision is called “Investor-State Dispute Settlement” (ISDS).

Agreements like NAFTA and the TPP essentially uphold the lowest common denominator in terms of worker and environmental protections as the desirable standard, opening up a wide range of domestic laws, protections, and policies to challenge by foreign investors.

Slow it down!

If you’ve heard anything about the TPP, you may have heard that there’s a measure on the table to “Fast Track” the entire agreement—the controversial Camp-Baucus bill—introduced on January 9.

Fast Track approval means Congress hands over its negotiating power to the executive branch. This is how the U.S. has handled several of our previous trade agreements, including NAFTA—and it means that only the Obama administration and its committee of (mainly corporate) advisers would see the full trade agreement before it’s approved.

Opposition is growing to this method of negotiations. Recently, two “Dear Colleague” letters opposing Fast Track approval circulated in the House of Representatives—with signatures from 173 representatives. It was a surprising mix of Democrats and Republicans.

Who knew that the issue to bring together both sides of the aisle in this dysfunctional Congress would be government transparency?! Voices from the Senate are beginning to object as well. Senator Warren (D-MA) wrote to President Obama voicing her deep concern, pointing out [PDF]: “If transparency would lead to widespread opposition to a trade agreement, then that trade agreement should not be the policy of the United States.”

The latest specifics we do know about the TPP come from last summer’s Wikileaks release of the Intellectual Property chapter. In it, we see a not-surprising theme of prioritizing profits over human need, dramatically demonstrated by the language on drug patent law.

As the current draft stands, the TPP would dramatically undermine the ability of several countries to provide access to life-saving medications, and according to Doctors Without Borders [PDF], would “severely restrict access to affordable medicines for millions of people.”

And the food system?

Agricultural policy is woven throughout the TPP and if Fast Track stays in place, we won’t get to read most of it until it is too late.

We did see one glimpse of ag policy in the intellectual property chapter: The TPP would require all involved countries to allow animal and plant life to be patented. We also know that the chief U.S. agricultural negotiator for the TPP is none other than former Monsanto lobbyist, Islam Siddiqui.

Knowing how Monsanto has viciously sued farmers over their Genetically Engineered (GE) seed patents and poured millions into fighting domestic GE labeling efforts, we can make an educated guess about Siddiqui’s TPP agenda.

The TPP would include a NAFTA-like elimination of virtually all tariffs on U.S. agricultural products, which could lead to commodity dumping and the subsequent dislocation of small farmers from their lands. Food safety rules—including rules about pesticide residue levels, labeling of GE ingredients, or limitations on additives—could be challenged under the Investor-State Dispute Settlement (ISDS). ISDS is a provision in major free trade agreements that allows companies to sue governments when local laws disrupt trade and profit.

We can look at how transnational corporations are using the ISDS provision in NAFTA to predict how the TPP court system will protect “investor rights.” In case after case, foreign corporations—including several of the Big 6 pesticide makers—have sued host governments for tightening environmental regulations or subsidizing local production. And in many of the cases, the corporations won multimillion dollar payouts.

We know enough not to support trade negotiations behind closed doors. And Congress has an opportunity to oppose Fast Track, today. It’s an important start.

An earlier version of this post ran on Ground Truth, the Pesticide Action Network (PAN) blog.

Mexico and Canada can impose $1bn in tariffs on US for meat labels, WTO rules

The World Trade Organization said US law of putting country of origin on packaged meats discriminates against North American trade partners

The World Trade Organization ruled on Monday that Canada and Mexico can slap more than $1bn in tariffs on US goods in retaliation for meat labeling rules it says discriminated against Mexican and Canadian livestock.

At issue were US labels on packaged steaks and other cuts of meat that say where the animals were born, raised and slaughtered.

The WTO has previously found that the so-called “country of origin” labeling law put Canadian and Mexican livestock at a disadvantage. It ruled on Monday that Canada could impose $780m in retaliatory tariffs and Mexico could impose $228m.

“We are disappointed with this decision and its potential impact on trade among vital North American partners,” said Tim Reif, general counsel for the Office of the US Trade Representative.

The labels are supported by some US ranchers and by consumer groups. They are opposed by meatpackers who say they require costly paperwork.

The WTO’s decision shifts responsibility to Congress, which is considering working a repeal of the labeling law into a massive year-end spending bill.

Senate agriculture chairman Pat Roberts, said Monday that he will look for “all legislative opportunities” to repeal the labeling law. “We must prevent retaliation, and we must do it now before these sanctions take effect,” Roberts said.

The labeling law was included in the 2002 and 2008 farm bills at the behest of ranchers from those northern US states who compete with the Canadian cattle industry. It has also been backed by consumer advocates who say it helps shoppers know where their food comes from.

———————————-

For Immediate Release: Contact:

May 18, 2016 Nicholas Florko, (202) 454-5108,

nflorko@citizen.org

TPP Study Projects Worsening Trade Balances for 16 of 25 U.S. Economic Sectors, Overall U.S. Trade Deficit Increase

Despite ITC Reliance on Model that Has Systematically Overstated Benefits of Trade Pacts Relative to Outcomes

WASHINGTON, D.C. — Today the U.S. International Trade Commission (ITC) released a study on the potential impacts of the Trans-Pacific Partnership (TPP). The report:

• Estimates a worsening balance of trade for 16 out of 25 U.S. agriculture (p. 124), manufacturing (p. 228), and services (p. 340) sectors that the ITC selected to feature. This includes vehicles, wheat, corn, autoparts, titanium products, chemicals, seafood, textiles and apparel, rice and even financial service. Autoparts would be hard hit with employment projected to decrease by 0.3 percent.

• Estimates the TPP will increase the U.S. global trade deficit by $21.7 billion by 2032.

• Projects even the U.S. services trade balance will worsen by 2032 as service imports of $7

billion swamp the estimated increase in exports of $4.8 billion (p. 35).

• Temporarily disregarding the fact that the ITC has underestimated the increase in the U.S. trade deficit caused by almost every pact it has assessed, the trade deficit increase the ITC does project from TPP implementation would equate to 129,484 American job losses, counting both exports and imports, according to the latest administration trade-jobs ratio. This makes even more curious the ITC estimate that the TPP would raise employment levels by 0.07 percent (128,000 jobs) in 2032.

• Estimates a decline in output for U.S. manufacturing/natural resources/ energy of $10.8 billion as exports would increase by $15.2 billion and imports would increase by $39.2 billion by 2032.

• Estimates tiny U.S. economic growth gains (42.7 billion or 0.15 percent) and income gains ($57.3 billion or 0.23 percent) by 2032. In other words, the ITC projects that the United States would be as wealthy on January 1, 2032 with TPP as it would be on February 15, 2032 without the TPP.

• Notes concern that the TPP would empower more foreign corporations to sue the U.S. government in private tribunals to demand taxpayer compensation over U.S. laws they claim violate their TPP rights and that the Investor State Dispute Settlement System is expanded to allow new grounds for financial service firms to challenge domestic policies (p. 36).

Statement of Lori Wallach, director of Public Citizen’s Global Trade Watch, on the Report:

“This report spotlights how damaging the TPP would be for most Americans’ jobs and wages given it concludes 16 out of 25 U.S. agriculture, manufacturing, and services sectors spotlighted by the ITC would see a worsening trade balance while the “upside” projection is miniscule gains in economic growth despite these findings being based on the same widely criticized methodology and unrealistic assumptions that have resulted in past ITC reports systematically overstating the benefits from trade deals that ended up causing serious damage.

Given that the ITC’s past studies on pending trade pacts have usually projected improvements in the U.S. trade balance and gains for specific economic sectors but the opposite occurred, that this study projects an increase in the U.S. trade deficit and losses for 16 of 25 U.S. economic sectors suggests that if ever implemented, the TPP could really be disastrous.”

How the ITC’s Faulty Methodology Has Systematically Led to Overly Optimistic Projections

The actual outcomes of past trade pacts have been significantly more negative than ITC projections generated using the same methodology employed for the TPP study. This makes today’s unusually negative ITC findings on the TPP especially ominous.

• NAFTA: U.S.-Mexico Trade

1993 – Baseline ITC Projection 2015 – Actual

$2.6 billion goods surplus $10.6 billion goods and $57 billion goods and (services data not available) services surplus services deficit

• China-WTO: U.S.-China Trade in Goods and Services

2000 – Baseline ITC Projection 2015 – Actual

$113 billion deficit $120 billion deficit $340 billion deficit

• U.S.-Korea FTA: Trade in Goods

2011 – Baseline ITC Projection 2015 – Actual

$15.6 billion deficit $10.6 billion deficit $28.5 billion deficit

The ITC’s TPP report uses the computable general equilibrium (CGE) model that had led to past ITC trade pact projections being entirely unrelated to actual outcomes by simply assuming away the very results that have often occurred under past pacts: long-term job loss, trade deficit increases and currency devaluations.

By design, the ITC CGE model assumed the U.S. trade balance would not change and that overall U.S. employment levels would remain constant – that workers who lose jobs will simply obtain new jobs in other sectors where wages are presumed to increase. Implicit in the assumption that the trade balance does not change is the assumption of flexible exchange rates.

But in reality, currency manipulation is a significant problem among some of the TPP countries. The U.S. Department of Treasury just recently included TPP nation Japan on its new Monitoring List in its semi-annual report on “Foreign Exchange Policies of Major Trading Partners of the United States.”

When Tufts University economists employed a model that allowed for job loss and increases in income inequality, they concluded that the TPP would reduce U.S. GDP by 0.54 percent over a decade and cost 448,000 American jobs. The Tufts findings spotlight just how drastically the assumptions baked into a CGE model used for the TPP study can affect the outcomes; the Tufts economists actually employed the Peterson Institute trade flow simulation data. They plugged the Peterson findings on import and export levels at full TPP implementation derived from one set of unrealistic assumptions into a model that applies more realistic assumptions about how trade flow changes affect growth and employment – and found that the TPP would cost hundreds of thousands of American jobs and drag down growth rates.

—————————-

What Is ISDS? (From the AFL-CIO)

An “investor-to-state dispute settlement” (ISDS) is a special legal right that only those who invest in a foreign country can use to challenge a law, regulation, judicial or administrative ruling or any other government decision. Investors are those who buy property—whether it’s an acre of land, a factory or stocks and bonds.

ISDS allows the foreign property owner to skip domestic courts, administrative procedures, city hall hearings and the like (all the processes that home-grown property owners use) and sue the host-country government before a panel of private “arbitrators” (like judges, arbitrators have the power to make decisions in cases, but they are not democratically elected or appointed, and they are not subject to stringent conflict of interest rules). Not only that but the foreign property owners don’t lose access to the domestic U.S. processes—they can “double dip” to get what they want.

What’s the risk?

The risk is that foreign property owners can use this system of “corporate courts” to challenge anything from plain packaging rules for cigarettes to denials of permits for toxic waste dumps to increases in the minimum wage. For any law, regulation or other government decision that the foreign investor does not like, all it has to do is think of an argument for why the decision somehow violated its right to “fair and equitable treatment” or why it might reduce its expected profits and it’s got a case. And, sometimes, just threatening the case is enough for the proposed law or regulation to be withdrawn.

What are some examples?

The North American Free Trade Agreement (NAFTA): In the Metalclad case, a U.S. corporation sued the Mexican federal government over a local government’s decision to deny a permit to operate a toxic waste dump. Local citizens felt the dump would pollute their water supply and petitioned their government to deny the permit. Metalclad won more than $15 million.

NAFTA: In the Methanex case, a Canadian company sued the U.S. federal government over the state of California’s decision to prohibit the use of MTBE as an additive in gasoline. Although Methanex lost the case, the state and federal government spent millions defending the case. Millions they would not have had to spend without ISDS: Methanex could not have brought the same complaint under U.S. domestic law.

See, these decisions don’t, by themselves, “overturn” the law, regulation or decision that was challenged. But if the country loses a case and wants to keep the decision that was challenged, it has to pay a fine (sometimes a substantial fine: Ecuador was recently ordered to pay more than $2 billion to Occidental Petroleum). And many countries will just change the rule instead of paying the fine.

Currently, in Europe, a Swedish corporation is using ISDS to sue Germany over its decision to phase out nuclear power, and a French company is suing Egypt over a number of labor market measures, including an increase in the minimum wage.

Are these the kind of cases we want European companies (in the case of Trans-Atlantic Trade and Investment Partnership) or Pacific Rim companies (in the case of the Trans-Pacific Partnership Free Trade Agreement) to bring against U.S. laws and regulations? The American people should be deciding what our policies should be, rather than letting foreign companies and their investors hold us up for ransom every time they don’t like our laws.

————————————

TPP and TTIP are sold as good for American Business since it supposedly will loosen trade with other countries.

Trans Pacific Partnership trade deal meeting in Atlanta

Posted: Oct 01, 2015 5:49 PM EDT

Updated: Nov 26, 2015 6:04 PM EST

By Vince Sims

CONNECT

ATLANTA (CBS46) –

Dennis Wolkin shows off a testing machine at Colgate Mattress Atlanta. It’s a small family owned business that has been around 60 years with about 30 employees.

“We would love to be able to ship out of the country but for a small business it’s a challenge working through all the regulations and shipping and payments,” Wolkin said.

That’s why Atlanta mayor Kasim Reed chose the plant to show other mayors and U.S. Trade Representative Michael Froman. Froman is in Atlanta for the closed door Trans Pacific Partnership (TPP) ministers meeting trying to reach a 12 country trade deal.

“The product made here by Colgate face up to 27 percent tariffs in some TPP countries,” Froman said. “Those tariffs would go to zero because of the trade agreement. And that could mean the difference in being profitable or not.”

“What we are trying to do is help 98 percent of American business that are small and medium sized companies,” Mayor Kasim Reed said. “But only about one to three percent of those are engaging in global trade. So we are trying to simplify the process.”

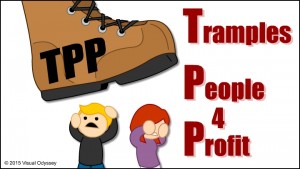

But many people oppose the TPP deal. Protesters gathered and marched at Woodruff park in downtown Atlanta making their voices heard.

“It’s corporations putting their bottom line over our bodies and over our lives,” Neil Sardana with Atlanta Jobs with Justice said. “It’s basically saying we are more important than your lives.”

The TPP trade negotiations continue Friday.

With trade talks in town, Reed, mayors thump for TPP deal

LOCAL GOVT & POLITICS By Katie Leslie – The Atlanta Journal-Constitution

Posted: 5:57 p.m. Thursday, Oct. 1, 2015

With trade representatives from around the globe convening in Atlanta this week, Mayor Kasim Reed joined a host of other U.S. mayors Thursday to call for conclusion to years-long negotiations over the Trans-Pacific Partnership.

At stake is a behemoth 12-nation trade deal that the Obama administration has argued will make easier for U.S. companies to export goods globally, and, therefore, create jobs. But opponents have blasted the pending agreement as secretive and a threat to U.S. labor standards and wages.

The so-called TPP deal would set rules affecting how much Americans pay for imports, how easily U.S. companies can sell products overseas, environmental and labor protections — and how it all would be enforced.

U.S. Trade Representative Michael Froman joined Reed, Little Rock Mayor Mark Stodola, Tampa Mayor Bob Buckhorn and Columbia, S.C. Mayor Steven Benjamin on a tour of Colgate Mattress Atlanta Corp. in Cabbagetown on Thursday.

Froman said Colgate — a family-owned manufacturer of crib mattresses — is “emblematic” of the need for a free trade pact with Asia partners. He noted that 98 percent of U.S. companies that export are small and medium size businesses, as are many in Atlanta.

“It’s those incremental exports that allow businesses like Colgate to add jobs, to pay better wages, to expand their operations. And that’s why it’s so important that we get these agreements done,” said Froman, who didn’t take questions from reporters.

The negotiations — taking place at the Westin Peachtree Plaza Hotel — pick up from talks in Hawaii last July. Officials are hoping to reach a deal this week after five years of talks.

Reed — a staunch supporter of President Barack Obama’s initiatives — said he believes the pact is key to growing exports and strengthening the country’s share of the global market.

“Businesses that engage in exports have a higher chance of survival and they pay higher wages,” he said. “At the end of the day, all of this is about folks having a job that gives them some dignity and allows them to support their families.”

Clarkston Mayor Ted Terry, Georgia AFL-CIO’s communications director, has myriad concerns with the potential deal, namely that it will benefit CEOs and not workers.

“Once TPP passes, it could last indefinitely. And other countries can join it without limit or oversight by the public or Congress,” he said. He fears that TPP “is a global race to the bottom, the bottom in environmental standards, the bottom in labor and wage standards.”

Oct. 1, 2015 – Atlanta – Protestors marched from Woodruff Park down Peachtree Street to the Westin Hotel, chanting and waving

His sentiments were echoed by hundreds of protesters, a cross-section of environmental, consumer watchdog and labor union groups, in separate rallies Thursday.

Colgate’s Vice President Richard Wolkin, who beamed as he walked the mayors through the factory his family has owned for about 60 years, admitted some worry about the pending deal. He’d like to expand his international trade, but is mindful of what impact the TPP will have on imports and his operations.

“Our wages are higher, our overheads are higher, and even more importantly our regulations are definitely stricter. We have undergone massive changes in those areas and those challenges,” he said.

Asked his prediction for whether TPP will be a boon for Colgate: “I can’t answer whether it will, in fact, be better for us or not.”

By the numbers:

• 14,000: The number of Georgia companies that exported goods in 2013.

• 150,000: The estimated number of jobs supported by export and import activity in Atlanta metro region.

• 360,000: The estimated number of jobs related to export and import activity at the Savannah port.

Source: Mayor Kasim Reed’s administration/The Office of the United States Trade Representative

—————————

Negotiations on Trans-Pacific Trade Pact Are Extended, Fueling Hope

By JACKIE CALMESOCT. 2, 2015

Protesters in Atlanta demonstrate against the Trans-Pacific Partnership trade deal, which negotiators may be close to completing. Talks have been extended a day.

Credit

Paul Handley/Agence France-Presse — Getty Images

ATLANTA — Trade ministers for 12 Pacific Rim nations, including the United States and Japan, on Friday neared agreement on an array of differences covering automotive, pharmaceutical and dairy exports, and decided to extend the negotiations into Saturday in hope of concluding the biggest regional pact in history.

The willingness to continue talks, which began in a hotel here on Wednesday, fueled optimism among the participating nations — and apprehension among critics hovering in its halls and monitoring the negotiations from afar — that the elusive Trans-Pacific Partnership was within reach after years of discussion.

Negotiators for the United States and Japan neared a compromise over the length of a phase-out of tariffs on cars and trucks made in Japan and sold in this country.

Yet sticking points persisted, including over compromise language from the American side on protections for drug makers, an issue that stymied previous talks in July in Hawaii.

It remained unclear whether President Obama would be able to claim an achievement central to his efforts to reorient the United States toward its fast-growing Pacific neighbors (rather than Europe and the Middle East), or whether the negotiators would once again pocket the progress made here and eventually stagger through another round of talks as Mr. Obama’s presidency wound down.

If a deal is reached, Congress would not render its verdict for months, well into a presidential election year in which anti-trade rhetoric is loud among Republicans and Democrats.

From Washington, Mr. Obama continued to lend his influence to his trade representative here, Michael B. Froman. On Thursday, the president called Prime Minister Malcolm Turnbull of Australia, who took power less than three weeks ago in a party shake-up, to confirm their mutual interest in signing an agreement.

But differences between their two nations — over protections for American drug makers and Australia’s desire to sell more sugar to the United States — are among the remaining obstacles. These differences led some observers to suspect an emerging trade-off on drugs and sugar. On Friday, seven Democrats on the Senate Agriculture Committee sent Mr. Froman a letter warning against concessions that could harm domestic sugar and dairy industries.

The talks also involve Canada, Mexico, Vietnam, Malaysia, Singapore, Brunei, New Zealand, Chile and Peru. Together, the 12 nations account for about two-fifths of global economic output.

By Friday, it seemed clear than any agreement would include provisions for autos that would phase out tariffs between the participating countries, require autos to have a certain share of parts made in treaty nations, lift nontariff barriers that effectively keep American autos out of Japan and create a process for settling disputes between governments over suspected violations of the agreement.

The large auto section in the Trans-Pacific Partnership presented substantive complications for the Obama administration, as well as domestic carmakers and unions, when Japan entered the trade talks in 2013, several years into the negotiations. Industry and union officials have been on site here, along with one member of Congress — Representative Sander Levin of Michigan, the lead Democrat on the House Ways and Means Committee, which has jurisdiction over trade.

A major issue for these industry and union officials has been how soon tariffs would be phased out on Japanese auto imports. The trade agreement will call for phase-out periods longer than those the Obama administration negotiated several years ago with South Korea, which is not a party to these talks. That separate bilateral pact ended tariffs in the fifth year for autos from South Korea, and phased out tariffs for its light trucks over a longer period.

While Japan has no tariffs on American-made autos, the emerging agreement would ease its other barriers to exports from the United States, like Japanese emission regulations and parts mandates that are difficult and costly for American carmakers to meet.

Also under the agreement taking shape, the process for settling auto-related disputes would include a “snapback” provision that the United States sought, which would allow it to revive tariffs if Japan violated the trade terms.

On another knotty issue — which pitted Japan against Mexico and Canada, even more than against the United States — the four countries were said to be nearing agreement on the so-called rules of origin to require that autos include a certain percentage of parts made by the countries in the Trans-Pacific Partnership to qualify for duty-free treatment.

The percentage would be higher than Japan wanted, but lower than the target pressed by Canada and Mexico. However, the trade agreement would also redefine what qualifies as locally made parts, in a way that Japan favors. By Friday, negotiators were down to haggling over rules of origin for axles, suspensions, belts and other parts.

Yet as important as any auto trade provisions are to American automakers, unions and their Democratic supporters, they were more concerned by a separate question over how the 12 nations would address currency manipulation that could give one country’s exports a price advantage over other nations. Japan has, in the past, artificially deflated the value of its currency to make its exports cheaper and United States imports more expensive. Mr. Levin said the trade pact would allude to currency manipulation, but language addressing it would be in a side agreement to the Trans-Pacific Partnership.

“We’ve learned in the last 15 years that currency is a critical part of trade,” Mr. Levin said, calling the proposed side agreement negotiated between the Treasury Department and Japan “a fig leaf.”

Mr. Levin said, however, that the issue was not the sole determinant of his support for a trade agreement. “It’s one factor,” he said.

Mr. Froman was particularly embroiled on Friday in trying to settle the pharmaceutical drug issues. The most vexing question was how long drug companies can have exclusive rights to data related to their development of so-called biologic drugs (products made from living organisms and considered promising for cancer treatments) before they must share the information with generic manufacturers.

The United States, which had insisted on 12 years to ensure drug manufacturers have incentives to innovate, recently proposed an eight-year provision as a compromise. It would give companies five years of exclusive rights followed by a three-year period of limited market sharing. But countries like Australia and Peru balked, and outside groups in the hotel corridors were quick to object again on Friday.

Peter Maybarduk, director of a program of the social advocacy group Public Citizen that seeks to expand global access to medicines, called the language put forth by the United States “an illusion, not an improvement. It is a repackaging of the same harmful idea already rejected by many countries.”

Small groups of protesters continued on Friday to try to interrupt the closed-door meetings throughout the hotel, shouting “No T.P.P.! No Secrecy!” At least two women were handcuffed and dragged away by security officials.

Trans-Pacific Partnership’s Potential Impact Weighed in Asia and U.S.

By KEITH BRADSHERJULY 8, 2015

HONG KONG — Willie Fung, a leader in the world’s bra industry, knows just what he will do if negotiators from the United States and 11 Pacific Rim nations complete a Trans-Pacific Partnership trade agreement this summer.

He says he will catch a flight to Vietnam to look at possible locations for a new brassiere factory. Mr. Fung’s company, Top Form, has built factories in China, Thailand, Cambodia and Myanmar, countries that are not part of the planned trade deal. That makes him worry that they may become less competitive if Vietnam qualifies for extra-low tariffs and the United States eases access in other ways to its vast market.

As the trade talks move toward conclusion, Mr. Fung said, garment industry tycoons here in Hong Kong “ask ourselves the question, ‘What does it mean to us?’ ”

After a bitter fight, the House and Senate approved legislation last month to allow President Obama and his successor to submit the Pacific pact and a potential agreement with Europe to Congress for an up-or-down vote with no filibusters or amendments permitted.

The draft text of the agreement has not been released, but emerging details suggest that it could have a substantial effect on a variety of industries.

Banks from rich countries like the United States and Japan would have the right to be treated more like local banks in less affluent countries, including Peru, Malaysia and Vietnam. Japan would be required to let in more American farm goods. Makers of pharmaceuticals would have an extra tool to protect their patents abroad, limiting competition from less expensive generic drugs. Auto parts would move more smoothly around the Pacific, with fewer taxes.

The Obama administration has been pushing the trade pact as a way to write new rules not just for the 12 nations involved but also as an umbrella to someday cover many other countries — above all, China.

Today’s Headlines: Asia Edition

Get news and analysis from Asia and around the world delivered to your inbox every day in the Asian morning.

One set of provisions requires that state-owned enterprises become less secretive and receive fewer government subsidies in the form of low-rate loans, cheap or free land and other assistance. The clause is initially aimed at Vietnam — as well as Malaysia and Singapore to some extent — but it offers a signpost for the direction in which the United States wants China to move.

Some Asian economists, particularly those from China, are skeptical that the Trans-Pacific Partnership will have a profound effect on commerce in the region. He Weiwen, a former Chinese Commerce Ministry official who is now a director of the influential China-United States-European Union Study Center at the China Association of International Trade in Beijing, said the potential expansion of trade from a possible China-led pact covering all of East Asia could be up to three times greater.

One shortcoming of the Trans-Pacific Partnership is that it has only one major consumer market, the United States, while the rest of the trading partners are essentially producers with limited demand for imported goods, said Terence Chong, who is the executive director of the Institute of Global Economics and Finance at the Chinese University of Hong Kong and is also a senior economist at Nanjing University in east-central China.

“There are not enough markets for the whole thing to develop — you need China as a market and producer,” he said. “You need more members; now it has only 12, but it may need 20.”

Such criticisms have not dissuaded the Obama administration from pushing ahead. One goal of the pact is to set streamlined rules on technical issues like standardizing the online processing of customs documents, a measure that could not only expedite shipments but also reduce the opportunities for bribing customs officials.

“The real impact, I think, is going to be on trade facilitation,” said Richard Vuylsteke, the president of the American Chamber of Commerce in Hong Kong.

The member countries of the new pact already have a series of bilateral free trade agreements and regional trade agreements that cover large chunks of their trade with each other. The two big exceptions are Japan, which has gone out of its way to protect its farmers, and Vietnam, which is embracing capitalism while remaining tightly controlled politically by its Communist Party.

But perhaps the single biggest driving force is geopolitical.

China has been making increasingly assertive claims of sovereignty over islands and seas close to Japan and Vietnam. That has left both countries willing to open their markets wider to trade with the United States, as a way to move further under the American security umbrella.

Vietnam in particular is trying to draw closer to the United States. Nguyen Phu Trong, the general secretary of Vietnam’s Communist Party and most powerful leader of the country, met with President Obama at the White House on Tuesday in the first such visit by a general secretary from his party.

While the Trans-Pacific Partnership has 12 members, the trade agreement “is in large part a Japan story and a Vietnam story,” said Peter Petri, an international trade economist at Brandeis University outside Boston.

American executives are often criticized for being oblivious to foreign markets even as business leaders overseas pay close attention to international trade. But one unlikely outcome of the contentious debate in Washington is that many American executives are now focused on the pact, even as it has attracted far less attention among their Asian counterparts.

John G. Rice, General Electric’s vice chairman for global operations, said that if the Pacific trade deal were not completed and approved, and if the Export-Import Bank were not reauthorized by Congress, the combination of the two events “would serve to move the U.S. to the back seat when it comes to global trade, and in the front seat you’re going to see a number of countries, including China.”

The bra industry offers one specific sign of what some of the shifting trade patterns from a successful Trans-Pacific Partnership might mean.

As it turns out, a move of bra manufacturing from China and some of its Southeast Asian neighbors to Vietnam could have a modestly beneficial effect on textile makers in the United States. That is because the partnership is virtually certain to include a “yarn forward” rule, specialists said. Such a rule, already found in the North American Free Trade Agreement, says that to qualify for low or zero tariffs while crossing borders within the regional trade pact, garments must be made from fabric woven in a member country, and that fabric must be made from yarn made in a member country.

Vietnam has low-cost labor but virtually no fabric production or yarn production, said Mr. Fung, who is the chairman of the Hong Kong Garment Manufacturers Association. The United States is the only country in the proposed trade zone with a cotton yarn industry or a cotton fabric industry of any size, and one of several countries in the pact with sizable production of synthetic fabric.

Freight costs to bring fabric from the United States to Asia are extremely low, largely because current trade flows across the Pacific lopsidedly consist of goods traveling from China to the United States. To avoid having shipping containers come back to Asia empty, freight companies accept very low rates for exporters in the United States who want to send cargo to Asia.

Foreign companies may eventually set up yarn and fabric factories in Vietnam. But this could take many years. The country has almost no one with the technical skills needed to operate and maintain the computerized equipment for these highly automated industries.

The Asian fabric industry is also dominated by mainland Chinese and Taiwanese companies, and they are worried about potential political risks if they establish operations in Vietnam.

When China set up an oil drilling rig early last year off the coast of central Vietnam, in waters claimed by both countries, industrial parks in Vietnam were convulsed by rioting that led to the burning of hundreds of businesses owned by mainland Chinese and Taiwanese companies alike. That violence has left such companies wary of further investment.

“There’s just an unease from what has happened in the past,” said Bradley Gordon, a lawyer based in Phnom Penh.

Low freight rates and preferential trade terms mean that American fabric is likely to be highly competitive in Vietnam until new factories eventually emerge there, Mr. Fung said. Top Form, which he led for decades before retiring last November, and where he remains an influential director, buys most of its fabric from China, but it also buys some from the United States. And Top Form, like many such companies, has been looking for ways to reduce its dependence on mainland China as wages there have soared.

So garment makers may set up operations in Vietnam for shipments to the United States, while buying substantial quantities of American fabric to supply their factories, Mr. Fung said. And fabric is a big part of the overall cost.

“If I sell a $10 bra to the United States,” Mr. Fung said, “$5.50 of the cost is the fabric.”

The Trans-Pacific Partnership: Questions and Answers

By MICHAEL D. SHEAR JUNE 16, 2015

Doug Mills/The New York Times

WASHINGTON — After a decade of negotiations among a dozen nations, the trade deal known as the Trans-Pacific Partnership, or T.P.P., is almost complete and ready for final consideration by Congress. But before President Obama can present the final document for approval, Congress must vote to give him the right to limit consideration of the T.P.P. to a single up-or-down vote, with no filibusters or amendments allowed. That is called trade promotion authority, or T.P.A., and, so far, Mr. Obama has failed to get it.

Q.What is the T.P.P., and who wants it?

A. The T.P.P. is a 30-chapter document that promises to ease trade restrictions among the United States and 11 Pacific Rim nations, which together represent an annual gross domestic product of nearly $28 trillion, or 40 percent of the world’s G.D.P. It is being pushed by Mr. Obama, many Republicans and a handful of Democrats on behalf of American businesses, who say it will open lucrative new markets. Critics, including most Democrats, say it is a giveaway to big business that will encourage companies to shift manufacturing jobs to low-wage nations.

Q.Why doesn’t Congress just vote on the T.P.P. when it is finished?

A. After years of mostly secret talks among the United States and other nations, the deal would unravel if United States lawmakers had the right to amend it. So backers are pushing to give the president T.P.A. — the ability to present the agreement as a take-it-or-leave-it decision. Lawmakers could not filibuster or amend the deal, but they could reject it. That is the way previous trade deals, including the North American Free Trade Agreement, or Nafta, were approved in Congress. If Mr. Obama doesn’t get T.P.A., he is certain to leave office without the trade deal he says is critical to the American economy’s long-term health.

Q. Didn’t the Senate already pass a bill giving T.P.A. to Mr. Obama?

A. Yes. In late May, a bipartisan coalition that included most of the Republicans and 14 Democrats agreed by a vote of 62-37 to give the president trade promotion authority for up to six years. But they did so only after reaching a deal with Democrats to include more money for trade adjustment assistance, or T.A.A., a program designed to help American workers displaced by global trade. That program is beloved by Democrats and hated by Republicans, who call it a waste of money designed largely to benefit labor unions. The legislation passed by the Senate packaged T.P.A. and T.A.A. together in a bid to win support from both parties — and it worked.

Trans-Pacific Partnership Countries

Generated by ai2html v0.51 – 0610-1045 ai file: Trans-Pacific-Partnership-MAP preview: 2015-05-21-tpp-map scoop : trans-pacific-partnership-map Artboard: 720 Artboard: 300 Artboard: 1050

Canada

United States

Japan

Mexico

Vietnam

Brunei

Malaysia

Singapore

Peru

Australia

Chile

By The New York Times

Q. So did the House take up the same package?

A. In the House, Speaker John A. Boehner chose to have lawmakers vote on the two parts of the Senate package — T.A.A. and T.P.A. — separately. He was betting that Democrats would ensure that the trade-assistance measure would pass, and that enough Republicans would back the T.P.A. so that it passed, too. Once both were approved in the House, Mr. Boehner thought, the package would go to Mr. Obama for his signature. And that would clear the way for final consideration of the trade deal.

Q. But it didn’t work out that way. What happened?

A. Democrats in the House who oppose the trade deal realized that they might not be able to defeat the authority part of the package. So instead, they decided to sacrifice the part of the Senate package that they liked — the trade assistance for workers — in a bid to halt the legislative progress. By voting en masse against the assistance measure (along with many Republicans, who oppose the program anyway), Democrats killed that part of the trade package. Even though the other part — the T.P.A. — narrowly passed, the package cannot be passed to Mr. Obama because it is different from what passed in the Senate.

Q. So what happens now?

A. That’s unclear. If the House could pass the trade-assistance part of the package, it could go to Mr. Obama for his signature. But there appears to be little support among Republicans in the House to pass a measure they dislike, and Democrats are refusing to budge. On Tuesday, Mr. Boehner pushed through an extension that allows members to consider the issue for another six weeks. That could allow Mr. Obama and his supporters to try to reach a deal in which Democrats drop their opposition to the trade assistance in exchange for getting something else they want. That could include promises of protections for workers or it could include unrelated measures, like passage of a long-stalled transportation bill.

Q. It’s so confusing, especially with so many similar-sounding abbreviations. Why couldn’t this all be simpler?

A. Very true. But perhaps Washington politicians are just adapting to the Internet slang common among young people. In 140 characters: Mr. Obama really wants to get T.P.P., but he needs T.P.A. and that requires T.A.A. Democrats like T.A.A. but will kill it to block T.P.A. #LOL

A version of this article appears in print on June 17, 2015, on page A18 of the New York edition with the headline: Issues and Obstacles in a Pacific Trade Deal.

—————————————————-

May 13 5 min read

TPP’s Hidden Climate Costs

By Joseph Stiglitz

President Obama has said that “no challenge poses a greater threat to future generations than climate change.” Yet the word “climate” is conspicuously missing from the Trans-Pacific Partnership (TPP). Worse, many provisions of the proposed trade agreement between the United States and 11 Pacific Rim countries could undermine critical policies and initiatives needed to contain global climate change.

All the evidence suggests that in order to limit global warming to the 2 degrees Celsius that scientists see as critical to avert the worst effects of climate change, we must retrofit global economic structures for production, investment, and trade. Instead, TPP would cement in place a system that treats the environment as distinct from and subordinate to international trade and investment.

Though trade negotiators may treat commerce and climate as separate problems, the emissions giving rise to climate change are in fact an unaccounted cost of the goods and services exchanged in our increasingly complex and globally integrated production and consumption chains. Not paying for these large social costs of pollution in production and global shipping delivers a hidden subsidy to the corporations polluting our global atmosphere.

Any good trade agreement would seek to do away with distorting subsidies to producers. One cannot have fair trade if firms are not required to pay the environmental costs they impose on society, which also present an existent threat to life on this planet. TPP does nothing to prohibit these typically hidden subsidies or others, such as subsidies for fossil fuels, buried within the tax system.

TPP is worse still because it creates the risk of lengthy lawsuits and sizable cash awards to investors for government actions that would rein in many of the current hidden subsidies for greenhouse gas pollution or ban climate-imperiling products and production methods. For instance, under TPP rules, government policies to incentivize more environmentally sustainable goods and services — even with voluntary labeling — can be challenged as illegal “technical” trade barriers unless the government has requested a specific policy exception in the existing agreement. Countries that lose such cases will face millions in sanctions unless they eliminate the policy favoring more socially and environmentally sustainable conditions.

Arguably, the countries party to TPP may not launch such attacks on each other’s climate policies, but the agreement’s expanded investor rights empower polluters to do so directly. TPP’s investor–state dispute settlement (ISDS) system allows foreign investors to sue governments for actions perceived as violating new rights afforded by the agreement and to demand compensation for expected future profits undercut by such policies. This threat creates an explicit obstacle to many government actions to reduce carbon emissions or other forms of climate pollution.

When investors bring disputes, they will be heard in private international tribunals stacked in favor of business interests. Arbitrators in such tribunals have repeatedly interpreted agreements like TPP to mean that changes to the policy environment harming their bottom line violate investor rights and deserve compensation, sometimes amounting to billions of taxpayer dollars.

Corporations in carbon-intensive resource extraction and electric utility industries are some of the biggest users of these ISDS mechanisms. In January, the energy company TransCanada launched such a challenge against President Obama’s decision to reject the Keystone XL pipeline, demanding $15 billion in compensation using the North American Free Trade Agreement’s (NAFTA) investor arbitration system. TPP would expand the scope of this system.

The threat cuts both ways: Currently the American firm Lone Pine is challenging Canada’s moratorium on hydrofracking under the St. Lawrence River. Unlike NAFTA, TPP explicitly would extend actionable investor rights to cover government contracts for the “exploration, extraction, refining, transportation, distribution or sale” of government-controlled natural resources like “oil, natural gas, … and other similar resources.”

Other seemingly arcane implications of TPP could also have big consequences for climate change. Current U.S. law requires the Department of Energy (DOE) to assess the economic impact and public interest before approving exports of liquid natural gas (LNG). However, the law also instructs the DOE to approve “without modification or delay” exports to any country with which we have a trade agreement.

DOE assessments make clear that exporting gas benefits gas companies (who can charge higher prices) while harming consumers and other businesses (who will pay more for gas and electricity). But more gas exports will also incentivize intensified hydrofracking, a natural gas extraction technique that is itself associated with significant greenhouse gas emissions. While shifting foreign consumers away from dirtier coal energy would be good, the worry is that the carbon-intensive costs of liquefying, transporting, and then reconstituting gas will more than offset carbon savings. A full public interest analysis might attempt to assess whether that is the case, but if TPP were enacted, U.S. officials would lose the right to review all LNG exports to TPP nations.

Crafted in secrecy with the help of corporate lobbyists, and with an eye to courting votes in a Republican-controlled Congress where climate change denial trumps science, no one should be surprised that TPP falls short of the “gold standard for 21st century international agreements” touted by the Obama administration. President Obama is reaching for a legacy on trade, but TPP’s harmful climate impact could dwarf his other laudable achievements.

Joseph E. Stiglitz is Senior Fellow and Chief Economist at the Roosevelt Institute and a professor at Columbia University. A recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979), he is a former senior vice president and chief economist of the World Bank and a former member and chairman of the (US president’s) Council of Economic Advisers. This is part three of an op-ed series being released by Professor Stiglitz in conjunction with the Roosevelt Institute.